In Brief:

-

The long-term financial challenges caused by the pandemic are still being felt today.

-

Payment plans can be an effective tool to help overcome the financial hardships of tuition payments.

Blog Post

The COVID-19 pandemic caused significant financial hardships for students and parents in higher education, with long-term financial challenges still being felt today. The pandemic highlighted the vulnerability of students and families when it comes to financing higher education costs. This blog explores the ongoing financial impact and how students and parents continue to navigate uncertainties during this unprecedented time.

Long-Term Financial Impact

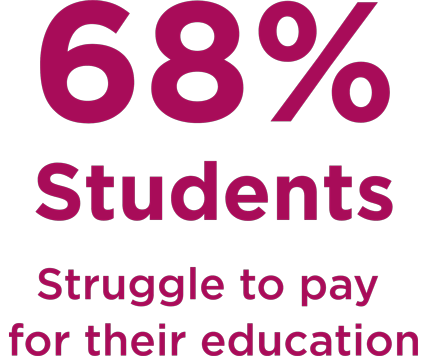

The financial impact of the pandemic on many families may be long-lasting. Even if they have managed to recover some of their lost income or employment opportunities since 2020, students are stressed by education costs. According to a study from Cengage Group, 68 percent of students said it is a struggle for them or their family members to pay for their education, with tuition being the biggest pain point. Though the majority of 4-year college students pay for their education on their own, about 29 percent split the costs with parents or family. If these families are still facing financial challenges, paying for tuition and related expenses may be difficult.

Continuing Uncertainty

The continuing uncertainty around the lasting effects of the pandemic and its economic impacts could also be affecting students’ and parents’ ability to plan for and pay for tuition. With widespread job losses and economic uncertainty, many families were and still are struggling to make ends meet, let alone save for their children’s college education. Many students are now hesitant to commit to long-term financial obligations such as tuition payments since they are unsure about their future financial stability. A 2015 financial wellness survey from the Ohio State University showed 70 percent of college students reported feeling stressed about their finances – including tuition and monthly expenses.

Changes in Financial Aid

In addition to personal finances affecting tuition payments, changes in financial aid offerings from higher education institutions have also played a significant role. The pandemic caused many institutions to shift their financial aid priorities or budgets, which has resulted in changes to the amount of aid available to families. This, in turn, has made it difficult for families to plan for and afford higher education costs. However, the pandemic relief funds from the Department of Education did provide some much-needed relief. For example, 94 percent of community colleges reported that these funds allowed them to keep students enrolled who were at risk of dropping out due to financial hardship.

Ease of Payment Plans

Payment plans can be an effective tool to help overcome the financial hardships of tuition payments by spreading out the cost of tuition over a longer period of time. Rather than paying the full amount upfront, payment plans allow students and families to pay in smaller, more manageable installments over several months. At Nelnet Campus Commerce, our Payment Plans make college affordable and accessible for students – no matter their situation. With a variety of payment options, our solutions help students eliminate stress by providing flexibility and helping them stay debt-free. And, our Payment Plans are fully automated, allowing students more time to focus on their education.

Overall, the financial effects of the pandemic may still be impacting families and their ability to pay for tuition in 2023. Higher education institutions should be aware of these challenges and work to provide flexible payment options, like payment plans, to help families overcome these barriers to accessing higher education.

Learn more about Nelnet Payment Plans

Author: Nelnet Campus Commerce